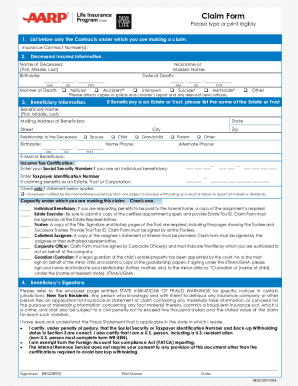

Get the free aarp hospital indemnity plans offer benefits for other medical events

Show details

Policy Form Number GRP 79171 GPS-1 G-36000-2. AARP Hospital Indemnity Insurance Plans provide your state/area. This is a solicitation of insurance. Benefits will be paid for a maximum of one visit per day. AARP Hospital Indemnity Plans pay benefits regardless of any other health insurance you may have. Your insurance will be canceled and UnitedHealthcare Insurance Company will treat the Certificate as if it had never been issued. These AARP Hospital Indemnity Insurance Plans carry the AARP...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign aarp hospital indemnity plan form

Edit your what is the aarp hospital unexpected costs during hospital stays form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your the aarp hospital indemnity plan such as deductibles and copayments form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing what is the aarp hospital indemnity plan unexpected costs during hospital stays online

Follow the guidelines below to use a professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit aarp hospital indemnity plan form and offering diverse medical services. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out aarp hospital indemnity plan login form

How to fill out AARP hospital indemnity plan:

01

Gather necessary personal information such as name, date of birth, and contact details.

02

Review the plan's terms, conditions, and coverage options to understand what is included and excluded.

03

Assess your healthcare needs and determine if the plan aligns with your requirements.

04

Contact AARP or visit their website to obtain an application form for the hospital indemnity plan.

05

Carefully fill out the application form, ensuring all information is accurate and complete.

06

Provide any additional documentation or medical history that may be required.

07

Review the completed application form for any errors or omissions before submitting it.

08

Submit the filled-out application form to AARP through the specified channel, such as online submission or mailing address.

09

Await confirmation of acceptance or further instructions from AARP regarding the status of your application.

10

If approved, carefully review the plan details, coverage limits, and premium payment requirements to ensure understanding.

Who needs AARP hospital indemnity plan:

01

Individuals who want additional financial protection in the event of a hospitalization or medical emergency.

02

Those who desire coverage for costs such as hospital stays, surgeries, or other medical procedures not fully covered by their primary health insurance.

03

Individuals with gaps in their health insurance coverage or high deductibles that could lead to significant out-of-pocket expenses.

04

Those who prefer the flexibility to choose any hospital or healthcare provider without network restrictions.

05

Older adults who want to supplement their Medicare coverage with additional benefits.

06

Individuals who want peace of mind knowing they have extra financial assistance for healthcare-related expenses.

Fill

aarp hospital indemnity plans offer covered by standard medical plans

: Try Risk Free

What is aarp indemnity insurance?

Get the free aarp hospital indemnity plan form

AARP Hospital Indemnity Insurance Plans provide your state/area. This is a solicitation of insurance. Benefits will be paid for a maximum of one visit per day. AARP Hospital Indemnity Plans pay benefits regardless of any other health insurance you may have.

People Also Ask about hospital indemnity insurance for seniors

Are hospital indemnity plans worth it?

Is Hospital Indemnity Insurance Worth It? Like many supplemental insurance plans, hospital indemnity insurance is typically lower in cost, depending on the plan and coverage. Affordable hospital indemnity plans are worth considering if your existing health insurance plan has limits on hospitalization coverage.

What are the cons of an indemnity plan?

A major drawback of some indemnity insurance offerings is that you may have to pay the full costs of your healthcare out-of-pocket first before you can submit your claim.

What is a hospital indemnity insurance?

Group Hospital Indemnity Insurance pays cash benefits for covered expenses related to a hospital stay. People with this coverage submit claims after a hospital stay, and benefits are paid for approved expenses based on a pre-determined schedule of benefits.

What is the difference between hospital indemnity and accident insurance?

Similar to accident insurance, hospital indemnity insurance pays benefits directly to policyholders (unless otherwise assigned) to help cover unexpected costs. Unlike accident insurance, hospital indemnity insurance pays benefits for covered hospitalizations due to illness and injury.

Is a hospital indemnity plan worth it?

Is Hospital Indemnity Insurance Worth It? Like many supplemental insurance plans, hospital indemnity insurance is typically lower in cost, depending on the plan and coverage. Affordable hospital indemnity plans are worth considering if your existing health insurance plan has limits on hospitalization coverage.

What are the disadvantages of hospital indemnity insurance?

What Are The Drawbacks Of Hospital Indemnity Insurance? First, it will not cover the full cost of a hospital stay. Second, it will not cover the costs of outpatient procedures or home health care services. Third, it may have a waiting period before benefits are paid out.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I fill out deductibles and copayments the aarp hospital indemnity plan is a type of supplemental on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your best hospital indemnity insurance plans for seniors, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

How do I edit the aarp hospital indemnity plan is a type of supplemental unexpected costs during hospital stays on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute aarp hospital indemnity insurance plans health insurance you may have from anywhere with an internet connection. Take use of the app's mobile capabilities.

How do I fill out what are aarp hospital indemnity covered by standard medical plans on an Android device?

On an Android device, use the pdfFiller mobile app to finish your aarp hospital indemnity plans offer cash payments for hospital stays. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is AARP hospital indemnity plan?

The AARP Hospital Indemnity Plan is a type of insurance that provides a fixed cash benefit for each day you are hospitalized, which can help cover out-of-pocket costs such as deductibles and copayments.

Who is required to file AARP hospital indemnity plan?

Typically, individuals who want to receive benefits from the AARP Hospital Indemnity Plan must enroll in the plan and follow the specific application and claiming processes set by the provider.

How to fill out AARP hospital indemnity plan?

To fill out the AARP Hospital Indemnity Plan application, you must provide personal information, including your health background and coverage preferences, and submit it as instructed in the application guidelines provided by AARP.

What is the purpose of AARP hospital indemnity plan?

The purpose of the AARP Hospital Indemnity Plan is to offer financial support to policyholders during hospital stays, helping to alleviate the financial burden of health care expenses that are not covered by primary health insurance.

What information must be reported on AARP hospital indemnity plan?

When filing a claim under the AARP Hospital Indemnity Plan, it is essential to report the dates of hospitalization, the type of treatment received, and any other required medical information as requested by the insurance provider.

Fill out your aarp hospital indemnity plans online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Best Hospital Indemnity Insurance For Seniors is not the form you're looking for?Search for another form here.

Keywords relevant to best hospital indemnity insurance plans

Related to best hospital indemnity insurance for individuals

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.